Nonprofit Accounting Basics

What Nonprofits Need to Know About Current Estimated Credit Losses - CECL

Have you been hearing the term CECL in financial and accounting circles?

CECL, pronounced “sea seal” is the common short-hand for Accounting Standards Update (ASU) 2016-13, Financial Instruments – Credit Losses (topic 326). CECL doesn’t just apply to financial institutions, it applies to nonprofits too.

The main goal of the standard is to improve financial reporting by requiring earlier recognition of credit losses on financing receivables and other financial assets.

Implementation Dates

The standard is applicable to nonprofits and the ASU is effective for non-public entities for fiscal years beginning after December 15, 2022. Implementation dates are as follows:

- Calendar Year Ends: To be adopted as of the beginning of the year ending December 31, 2023. (January 1, 2023)

- Fiscal Year Ends: To be adopted as of the beginning of the fiscal year which ends in 2024. (First day of the fiscal year)

New Requirements

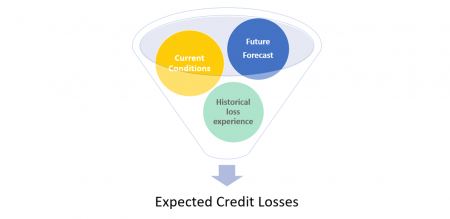

The standard requires establishing a methodology for estimating credit losses of balances within the scope of the standard that considers the past, present and future. The standard also requires documentation of the analysis and calculation. Items with similar risk characteristics may be grouped together for this purpose.

- Past

- Historical experience with credit losses

- Look back of five years at minimum (if possible)

- Present

- Current considerations related to the likelihood of collection

- Consider qualitative and quantitative factors related to economic conditions effecting customers

- Future

- Forecast information related to the future that has an impact on the likelihood of credit losses.

- Reasonable and supportable forecast

- Time period of forecast should relate to period over which asset is expected to be collected

- Document rationale for the forecast period

- Provide evidence which supports the reliability and accuracy of economic forecast

For nonprofit organizations which hold the types of balances included in the scope of the CECL ASU, this means they will most likely need to estimate and record an allowance for doubtful accounts, or Allowance for Credit Losses (ACL). For many nonprofits, this may be the first time they do so.

Important Note: After the implementation date for your organization, the incurred loss impairment method, under which adjustments to receivables are made when they become uncollectible, is no longer compliant with generally accepted accounting principles in the United States (GAAP).

Certain types of balances held by nonprofits are included in the scope of the CECL ASU, while other types of balances held by nonprofits are excluded.

Five Most Common Types of Balances Scoped In (Included) for Nonprofits:*

1. Accounts receivable

- This includes all accounts receivable that result from exchange revenue transactions

2. Contract assets which are the result of exchange revenue transactions or other income

3. Notes or Loans receivable from an unrelated entity, including programmatic loans receivable

4. Loans receivable from officers or employees

5. Receivables related to operating leases held by a lessor

Five Most Common Types of Balances Scoped Out (Not Included) for Nonprofits:*

1. Contributions receivable

- This includes all contributions receivables no matter whether you call them Promises to Give, Grants, Donations, Pledges, Gifts or other names

2. Financial Assets reported at fair value, such as investments

3. Intercompany notes or receivables including those between parties under common control

4. Receivables arising from operating leases

5. Loans made to participants by defined contribution employee benefit plans

*See the full standard and full list of balances scoped in and scoped out at: FASB ASU 2016-13

The Analysis

- Perform when the receivable, loan, or other scoped in item is established and update regularly, on at least an annual basis

- Group similar items into pools and develop an appliable rate that considers historical loss rate, current conditions and future forecast for the type of instrument and type of customers / entities in that pool, to determine the allowance for credit losses for that pool

- The most relevant methods for nonprofits include:

- Loss-rate (aging) method for accounts receivable

- Discounted cash flow for loans receivable including programmatic loans receivable

Important Note: Organizations will no longer be able to assert that receivables are 100% collectible without providing significant documentation, using the CECL framework, to support that claim. This includes cases where the risk of loss is highly remote, even for these, Organizations are required to estimate the lifetime credit losses for balances within the scope of ASU 2016-13.

Required Disclosures:

- Statement of Financial Position – possible additions:

- Contra Asset - Allowance for Credit Losses (ACL) for accounts receivable

- Liability - Reserve for unfunded commitments for notes and loans receivable

- Statement of Activities – possible additions:

- Provision for credit losses

- Unfunded commitments

- Statement of Cash Flows – possible additions:

- Provision for credit losses

Note Disclosures – including:

- Description of the Organization’s accounting policies and methodology for estimating the ACL, including past events, current conditions and reasonable and supportable forecasts

- Discussion of risk characteristics related to each relevant balance

- Roll-forward of the ACL (Allowance for Credit Losses)

- Discussion of changes to arrive at the current year CECL versus the prior year CECL

- Any changes to the Organization’s accounting policies and methodologies from the prior period, the rationale for those changes and the quantitative effect of those changes

- Any changes to balances scoped into the CECL ASU

- Aging analysis of the amortized cost basis for certain financial assets that are past due