Accounting and Bookkeeping

Line of Credit

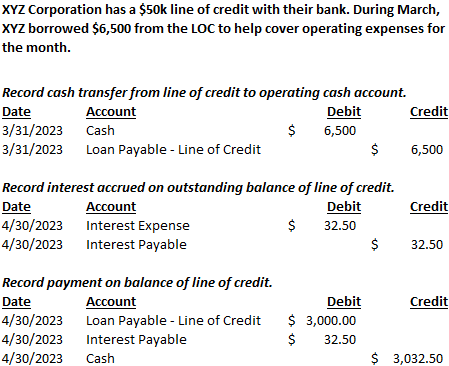

Similar to a personal credit card, a line of credit (LOC) is a pre-set credit limit approved by a bank or another financial institution. An organization can draw on a line of credit as needed and repay the loan over time or as defined by the LOC terms. A line of credit, does not appear on the books of the organization until money is borrowed. When money is borrowed, the amount is recorded as a loan in the liability section of the Statement of Financial Position along with the interest owed on the outstanding balance. The interest payable amount is driven by the borrowing rate on the line of credit.

Below are examples of journal entries showing activity associated with a line of credit.