Accounting and Bookkeeping

Fixed Assets

Fixed assets are physical assets with long useful lives, such as buildings, furniture, computers, office equipment, machinery, and vehicles. They are used by an organization to support its operations (ex: desks, and chairs) or to generate revenue (ex: machinery used to manufacture goods). Fixed assets are also known as Property, Plant and Equipment (PPE) and can be found in the long-term asset section of an organization’s Statement of Financial Position/Balance Sheet.

The criteria that determine whether a purchase is classified as a fixed asset is dictated by the organization’s capitalization policy, which establishes the following:

• Capitalization threshold: The minimum cost that qualifies as a fixed asset

• Useful life: The number of years a fixed asset is serviceable or in use

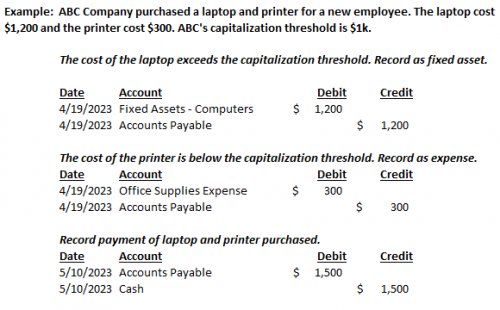

Capitalization Threshold

The minimum value at which an item qualifies as a fixed asset varies by organization. It can also vary based on the size of the organization. The capitalization threshold can range from $500 to $1k for small entities to $5k to $10k for large organizations. Items that fall below the threshold are recorded as expenses in the period of purchase.

Useful Life

An asset’s useful life is an estimate of the number of years an asset will be used, i.e., provide value to the organization. IRS guidelines and industry standards are good references to consult in determining the useful life of assets.

Depreciation Expense

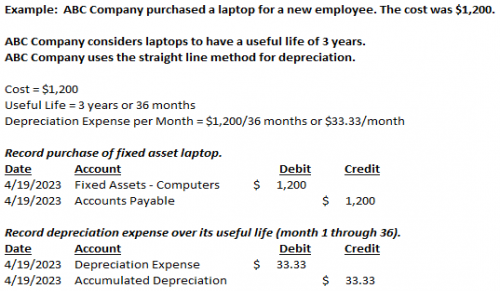

If an item qualifies as a fixed asset, the cost of the item is depreciated over the useful life of the asset as 1) an expense (on the Statement of Activities/Income Statement) and 2) reduction in value of the asset (on the Statement of Financial Position/Balance Sheet). Depreciation expense represents the decrease in the value of the asset as a result of use.

The simplest and most common method of calculating depreciation is the straight-line method, which is calculated as the asset’s cost divided by its useful life. Below are sample journal entries illustrating the acquisition of a fixed asset and recognition of depreciation expense.

The underlying premise behind the accounting treatment of fixed assets is the matching principle, which requires that the benefits received from the asset are offset or “matched” by its cost in the same period. For example, an organization may pay $1,200 to purchase a laptop in April but the laptop will be used by the organization for multiple periods beyond April. Depreciation expense spreads the cost of the asset over the period in which the asset is utilized by the organization