Nonprofit Accounting Basics

Lessons Learned from Adoption of Topic 606, Revenue Recognition

In May 2014, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) 2014-09 Revenue from Contracts with Customers (Topic 606) to clarify revenue recognition guidance and thereby improve financial reporting. Nonprofit entities who adopted the standard early quickly learned that there is a significant learning curve to properly recognizing revenue under the new standard. Whether your organization adopted early or is still new to the Topic 606, some general best practices have emerged from some difficult lessons learned.

Provisions of Topic 606

FASB created Topic 606, and International Accounting Standards Board (IASB) issued International Financial Reporting Standards (IRFS) 15, to clarify revenue recognition and develop a common revenue standard. Topic 606’s guidance supersedes that of Topic 605, Revenue Recognition, and most industry-specific guidance throughout the Industry Topics of the Codification. Its core principle for revenue recognition is to “depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services.”

Later, FASB issued ASU-2018-08 Clarifying the Scope and Accounting Guidance for Contributions Received and Contributions Made (Topic 958). This guidance is intended to clarify and improve the scope and the accounting guidance for contributions received and contributions made. Key provisions in this guidance include clarification regarding the accounting for grants and contracts as exchange transactions or contributions, and improved guidance to better distinguish between conditional and unconditional contributions.

Why was this needed?

- Remove inconsistencies, comparability, and weaknesses regarding the recognition of one of an organization’s most important metrics (Revenue)

- More robust but fluid standard whereby one model is used to apply to all types of revenue transactions

- Address today’s transactions and future transactions

For a comprehensive guide to implementing, AICPA published Financial Reporting Brief: Roadmap to Understanding the New Revenue Recognition Standards.

Exchange Transactions and the 5-Step Process

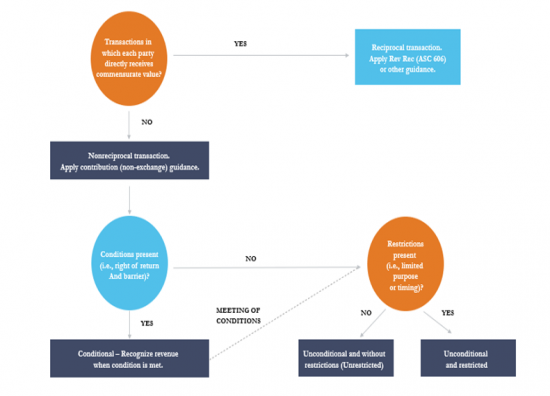

Before implementing the appropriate standard, you must determine whether the transaction is an exchange transaction or a contribution. An exchange transaction is “a reciprocal transfer between two entities that results in one of the entities acquiring assets or services or satisfying liabilities by surrendering other assets or services or incurring other obligations”. With a contribution, the benefits flow to the general public rather than to the funder. Refer to the Nonprofit Revenue Recognition Decision Process chart above to assist in your determination.

If the transaction is determined to be an exchange transaction, to achieve the core principle noted above, entities must apply a 5-step process to recognize revenue.

- Identify the contract(s) with the customer

- Identify the performance obligations in the contract

- Determine the transaction price

- Allocate the transaction price to the performance obligations

- Recognize revenue when (or as) performance obligations are satisfied

Contribution Transactions – Conditional and Unconditional

If the transaction is deemed a contribution, you must determine whether the contribution is conditional or unconditional. A donor-imposed condition must have a barrier and a right of return to the promisor for assets transferred or a right of release of the promisor from its obligation to transfer assets as determined from the agreement (or another document). If the transaction is conditional, you cannot recognize revenue until the conditions on which they depend have been substantially met. For your convenience, refer to the Nonprofit Revenue Recognition Decision Process chart above to assist in your determination.

If unconditional or upon meeting conditions, you must determine whether the donor has restricted their contribution for a specific purpose or time. If either, you must record such revenue as with donor restriction. Donor imposed restrictions are released when the restriction expires, that is, when the stipulated time has elapsed, when the stipulated purpose for which the resource was restricted has been fulfilled, or both. Other donor-imposed restrictions are perpetual in nature, where the donor stipulates that resources be maintained in perpetuity. Gifts of long-lived assets and gifts of cash restricted for the acquisition of long-lived assets are recognized as revenue without donor restrictions when

the assets are placed in service.

Lessons Learned

With a few years under their belt since Topic 606’s introduction, most nonprofit organizations have a good handle on the provisions of the new guidance. Those who implemented early can now focus their attention on refining their documentation and/or implementing other new standards like leases (ASC Topic 842), while later adopters benefit from some of the lessons learned that are now becoming best practices for successful implementation.

Best Practices for Implementing Topic 606

- Educate your leadership and other key stakeholders. As a first step, finance staff should read the guidance and summarize how the guidance will impact your organization for your audit committee and board of directors. Avoid a potential disconnect during implementation by explaining the benefits and clearing outlining the impact. Also, discuss your organization’s approach with your auditors to avoid any surprises during the annual audit.

- Documentation. Some organizations have made the mistake of waiting to perform their analysis as the annual audit approaches. Your finance team should inventory all revenue streams, perform the analysis early, and document all conclusions. Many organizations also find it helpful to template the analysis documentation, and the documentation of any new policies and procedures will ensure consistency year after year.

- Understand performance obligations. Prior to Topic 606, many organizations just recorded contract revenue based on cash received and careful contract review was not required. Under the new standard, the communication between the accounting/finance function and other areas of the organization that carry out the program or provide the service is critical to understanding when a performance obligation is fulfilled, and therefore how revenue will be recognized. Without a clear understanding of the contract and how the terms and conditions align with the purpose of the revenue source, organizations cannot separate out the performance obligations and recognize revenue by each unique obligation in the contract.

- Re-evaluate the impact to your organization following implementation. Implementation of any new accounting standard is a process that should be reviewed and refined. Determine if your documentation adequately supports the treatment in your accounting records for your current revenue streams. Look forward and be prepared to utilize your templates and tools for new contracts or new potential revenue streams.

Nonprofits should look to other organizations who have successfully implemented Topic 606 as a model and keep these best practices in mind as they develop their own strategies for implementation of the standard. Engaging an experienced CPA in the process can also provide the support needed to ensure a smooth and efficient transition.