Nonprofit Accounting Basics

Alternatives to Financial Statement Audits

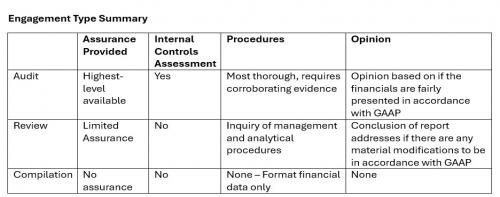

While financial statement audits are mandatory for many organizations, a review or compilation may meet the needs of some. Understanding the differences between an audit, review, and compilation can help your organization select the best engagement to meet your financial reporting goals.

Audit, Review, and Compilation – Key Differences

Audit

An audit provides the highest level of assurance from a CPA. It includes an inspection of internal controls, a fraud risk assessment, and other procedures designed to obtain reasonable assurance that the financial statements are free from material misstatement. This level of engagement will require the organization to provide evidence to support the values reported. The independent auditor issues an opinion stating whether the financial statements are fairly presented in accordance with Generally Accepted Accounting Principles (GAAP) or another applicable financial reporting framework.

Review

A review offers limited assurance. The CPA performs inquiries and analytical procedures but typically, does not perform audit procedures such as testing transactions. In contrast to an audit, a review does not involve a detailed analysis of internal controls. The review report states that the CPA is not aware of any material modifications needed to ensure that the financial statements conform to GAAP or another financial reporting framework.

Compilation

A compilation involves organizing the client's data into financial statements without providing any assurance on the financials. No audit or analytical procedures are performed. The CPA compiles the financial statements without offering an opinion or providing any assurance on the financial data.

What to Expect During the Engagement Process

During a review or compilation, your CPA will expect that all transactions for the relevant period are accurately recorded in your accounting system, and that key balance sheet, revenue, and expense accounts are properly reconciled with supporting schedules.

Any additional information needs will depend on the engagement type. Generally, the higher the level of assurance provided, the more information that will be required. For example, audits will require the most information, including corroborating third-party evidence, while reviews and compilations will most likely only need internally produced records.

Your CPA may request documents such as bank reconciliations, accounts receivable aging reports, fixed asset schedules, accounts payable aging reports, loan balance support, and salary reconciliations to IRS payroll returns. They will also review information about your business purpose, accounting policies, and details on loans, leases, retirement plans (if applicable).

An in-person meeting or phone call will be scheduled to discuss necessary inquiries and any clarifications on information provided.

When Does an Organization Need a Financial Statement Engagement?

Financial statement requests can vary, and terms like "CPA-prepared financial statement" are often used loosely. When financial statements are requested, it is best practice to identify the specific level of financial statements that are needed before assuming an audit is needed. In cases where a third party is requesting the engagement, take the time to verify the needs with the third party. For example, a debt covenant may require a financial statement audit and the lender may stick to that requirement. However, some lenders may accept a review report.

Kari Hipsak, CPA, CGMA-Coauthor